The trials and tribulations of selling insurance through an app

Most people know that insurance is a pretty antiquated industry. So it will probably come as no surprise when we tell you that Cuvva is the first and only company in the UK to sell car insurance via an app.

Being the only mobile first car insurer has its advantages and disadvantages. The major advantage is that we have a first mover advantage and offer a superior customer experience to that of our competitors. However, it comes with a fair share of problems.

There has been very little innovation in they way consumers buy car insurance and it hasn't changed that much since they first started selling policies online. What this means is that consumers are used to buying insurance from a website and not through an app.

The pros and cons of apps

Apps are great, don't get me wrong, and everyone loves them but it is getting people to install them that's the problem. Websites are easy, you either enter the url and go directly to the website or click a link on another page and you're there.

With apps it's more complicated as you have to install them first and to install them you have to go to the relevant app store and find them.

If a friend told you about an app then the typical journey looks like this:

Friend's recommendation - App Store - Install App - Open app

If you hear about an app through advert or new article then the typical journey is even more complicated:

Advert - Google Search - App website - App Store - Install App - Open App

Every step you add reduces the number of people who make it through to the end so we need to make the process more streamlined, especially as we need to take people from web to app.

The advantage however, is when the user is on the app it allows them to buy a policy in seconds rather than spending ages on hold or having to re-enter all your personal information every time you want to buy a policy.

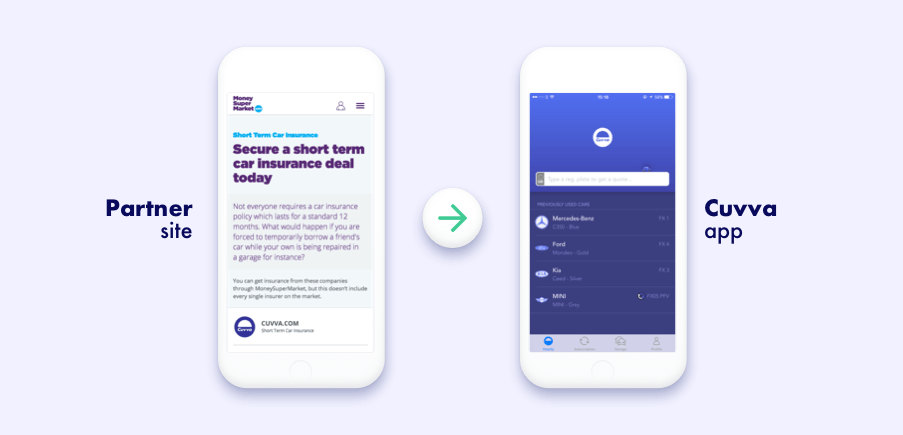

Streamlining the user journey

To help streamline the customer's journey we use a tool called Branch which specialises in doing exactly this.

Using Branch we can create smart deep links which will direct the user based on where they have come from and what they to do. It enables us to do the following:

- direct them to the appropriate app store depending on what device they are on - if they're on desktop, they can send themselves a text message with the link

- take them directly to the app if they already have it installed

- take them to a specific screen within the app - e.g. if a user installs Cuvva from a Facebook ad for our subscription product then they will automatically be taken to the subscription screen

Using deep linking services like Branch enables us optimise the user's journey from web to app as efficiently as possible. In the future we want to optimise the journey even more by offering a more personalized onboarding experience which we will detail in a later blog post.

If you have any ideas or suggestions for us then let us know on via the in-app chat.

Follow us on...

Team member