Choose your cookie preferences

Cookies help us make this website work better for you. Some cookies are essential for the site to function, while others let us personalise your experience. It's up to you which cookies you accept. For more details on how we use cookies to enhance your experience, you can read our cookie policy.

Car insurance for up to 28 days

Short-term car insurance for up to 28 days. Fully comprehensive cover without being tied into an annual contract. Insure your car, borrow someone else’s or cover a van for 28 days with no nasty hidden fees or interest.

1 hour to 28 day car insurance

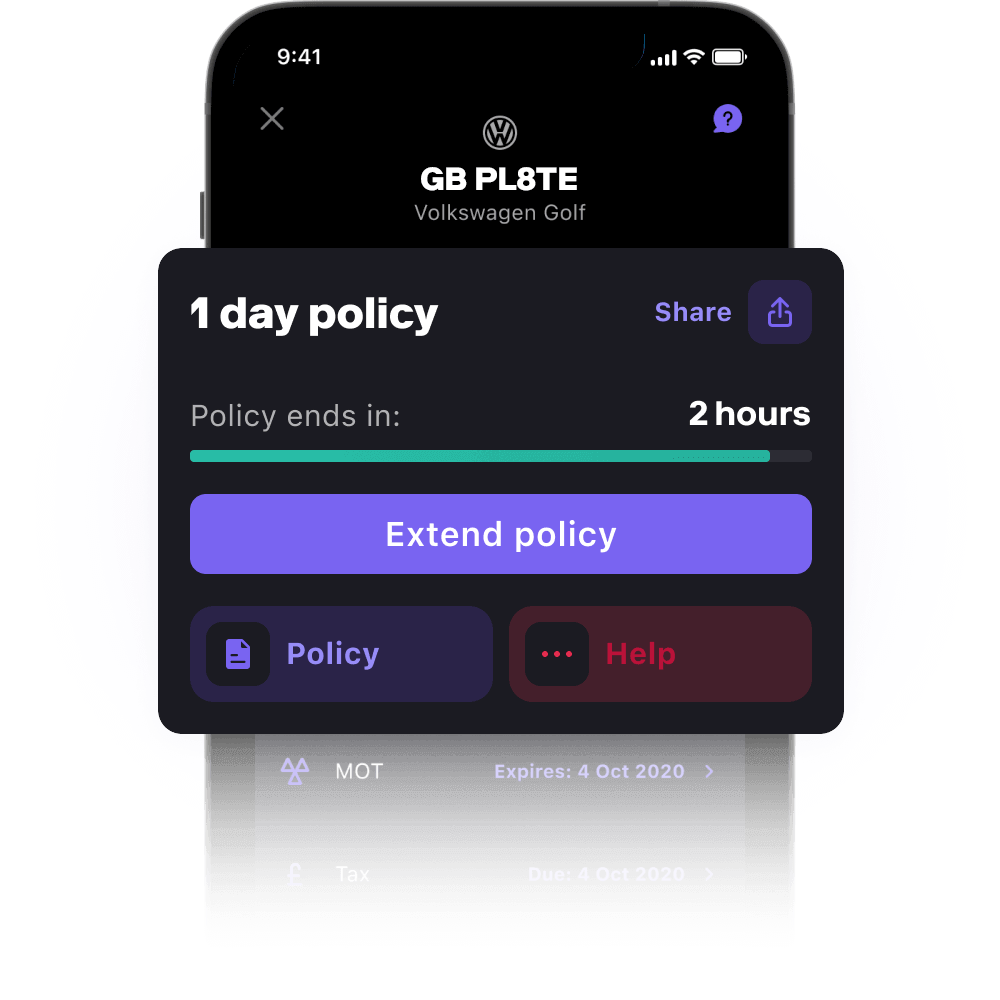

Flexible policies for ultimate peace of mind. Just head to the app, choose your cover from 1 hour to 28 days, and get driving. Don’t get tied into a longer contract than necessary. With Cuvva, you only pay for the cover you actually need. Policy ends and you fancy another one? Jump on the app and get a new one. It starts instantly.

Car insurance - without the interest rates

Monthly car insurance common questions

Can I buy insurance for just 1 month?

With Cuvva’s short term car insurance, you can buy a policy from 1 hour to 28 days. When it expires, you can get another one if you want.

Can you use 28 days insurance to drive an uninsured vehicle to a MOT centre?

As long as it has an active MOT and doesn’t have a SORN status, you can use a short term policy of any length to drive to the centre.

Can you add an additional driver to your 28 day car insurance?

Your friend or family member can get their own cover using the Cuvva app quickly and easily, with policies from 1 hour to 28 days.

To help save money, invite them to join Cuvva and you’ll both get £10 off when they take out their first short term policy.

Is there anything you don’t get with a 1 month’s car insurance that you do with an annual policy?

A Cuvva short term policy gets you fully comprehensive cover to protect you, your car, others and their property. Your policy will also be on the Motor Insurance Database (MID), like any annual car insurance policy. short term insurance has no deposits or interest charges. Plus you can manage it all in Cuvva’s app.

It’s worth bearing in mind however, you won’t be able to build a no claims bonus like you would with an annual policy.

One place to manage your car

Get covered, view your documents and manage your details - all through our app.

You can also see information about the car, and set reminders for your tax and MOT. And if that wasn't enough, you can chat to us too. We're here every single day of the year.

Fully comprehensive. And then some

Here's what you're covered for with our short term car insurance.

Damage to your vehicle up to £40k

Damage to third party property up to £2m

Your legal liability to other people arising from an accident

Attempted theft

Theft

Fire damage

Carriage of own goods business use - for vans as well as cars

Up to £400 for after-fit audio equipment and £100 for your things

Driving after 10pm

What is pay-monthly car insurance?

Most traditional pay-monthly insurance policies are credit agreements. In other words, you split the total cost of an annual policy over 12 months. This means you end up paying lots of interest. With some insurers, the APR is almost 40%.

While pay-monthly insurance might sound flexible, it’s actually just a sneaky way that some insurers charge even more for an annual policy. It could be a better option to instead take out a short term car insurance policy whenever you need to borrow a car.

Who we cover

To use Cuvva's car insurance for the first time, you'll need:

To be 19 to 70 when your policy starts

A UK licence or a full licence from most EU countries

A car that's at most 40 years old

A car that's worth up to £60,000

You deserve a better type of car insurance

The car insurance industry wasn’t built for how people live today. We want to make car insurance more affordable and fairer, and to give anyone access to a car, anytime, anywhere.